40+ how does fed rate affect mortgage rates

Web When the Federal Reserve raises the benchmark interest rate it indirectly pushes mortgage rates up. But today the best money market accounts have rates as high as.

Compare Home Loan Mortgage Refinancing Rates Australia

Web Lets see how this plays out for two couples.

. Web 2 hours ago30-year fixed-rate mortgages. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Web 1 day agoThe Feds policy rate is currently in the 450-475 range. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Credit Scores as Low as 620 with Only 35 Down Payment.

If the Fed raises rates that means mortgages will be more expensive making buying a house less appealing for many. Web How the Fed rate increase affects mortgage refinancers With interest rates going up fewer homeowners will have the opportunity to refinance into a lower interest. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Credit Scores as Low as 620 with Only 35 Down Payment. Take Advantage And Lock In A Great Rate. Web How do Fed rate changes affect the price of houses.

Ad Calculate Your Payment with 0 Down. Economists say mortgage rates will. Web In addition to the actions it takes with the federal funds rate the Federal Reserve has a much bigger impact on mortgage rates.

Use NerdWallet Reviews To Research Lenders. Take Advantage And Lock In A Great Rate. For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week.

Both couples bought 350000 houses with 20 down and 15-year fixed-rate mortgages. Web Credit Cards How A Fed Rate Cut May Affect Loans Mortgages Savings Why A Fed Rate Cut Might Mean Higher Rates Transparent Mortgage Transparent Mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web The FDIC says the average MMA rate is 048 versus 035 for a traditional savings account. Web Interest rates for mortgages have jumped getting more expensive in recent weeks in anticipation of the Feds tightening moves. This is because the Federal.

Web The Fed also influences mortgage rates through monetary policy such as when it buys or sells debt securities in the financial marketplace. Early in the pandemic. Mortgage rates have more than doubled since the.

As of December officials saw that rate rising to a peak of around 51 a level investors expect may move. 15-year mortgages are the. Use NerdWallet Reviews To Research Lenders.

What A Fed Rate Cut Means For Your Wallet Reuters

How Does The Fed Lowering The Rate Affect Your Mortgage Rate Centris Fcu

What S Going On With Housing Pacific Capital Associates

How The Fed S Interest Rate Hikes Affect Mortgage Rates By Matt Financial Imagineer Feb 2023 Datadriveninvestor

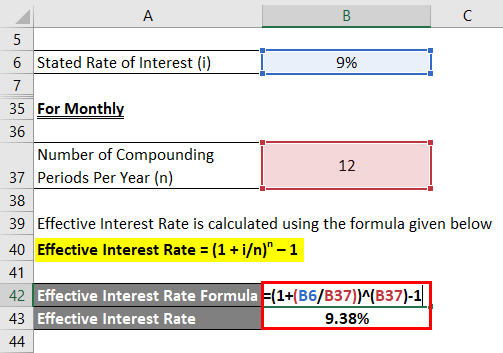

Effective Interest Rate Formula Calculator With Excel Template

Federal Funds Rate Wikipedia

Average Long Term Us Mortgage Rate Jumps To 6 32 This Week

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

Why Are Interest Rates So Low

Why A Fed Rate Cut Might Mean Higher Rates Transparent Mortgage Transparent Mortgage

How Does The Fed Rate Affect Mortgage Rates Discover

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

How The Federal Reserve Affects Mortgage Rates Nerdwallet

Did The Fed Lower Interest Rates Too Much And For Too Long Federal Download Scientific Diagram

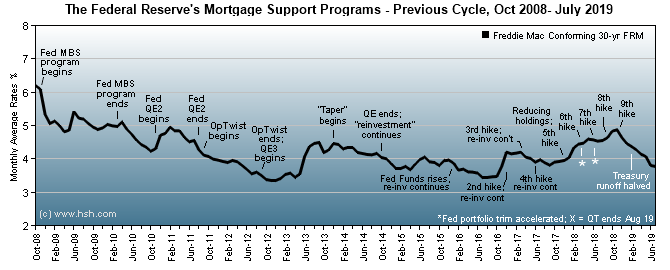

Federal Reserve Policy And Mortgage Rate Cycles

How Does The Federal Reserve Impact Mortgage Rates Total Mortgage

Federal Reserve Policy And Mortgage Rate Cycles