38+ Paying extra on my mortgage calculator

The interest rate youre charged will significantly influence how much you end up paying back on your home loan. Found on the Set Dates or XPmts tab.

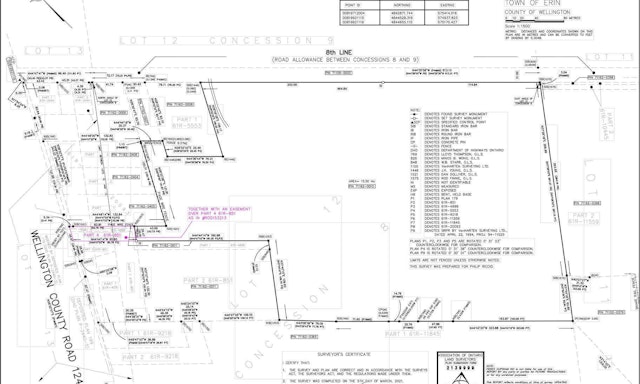

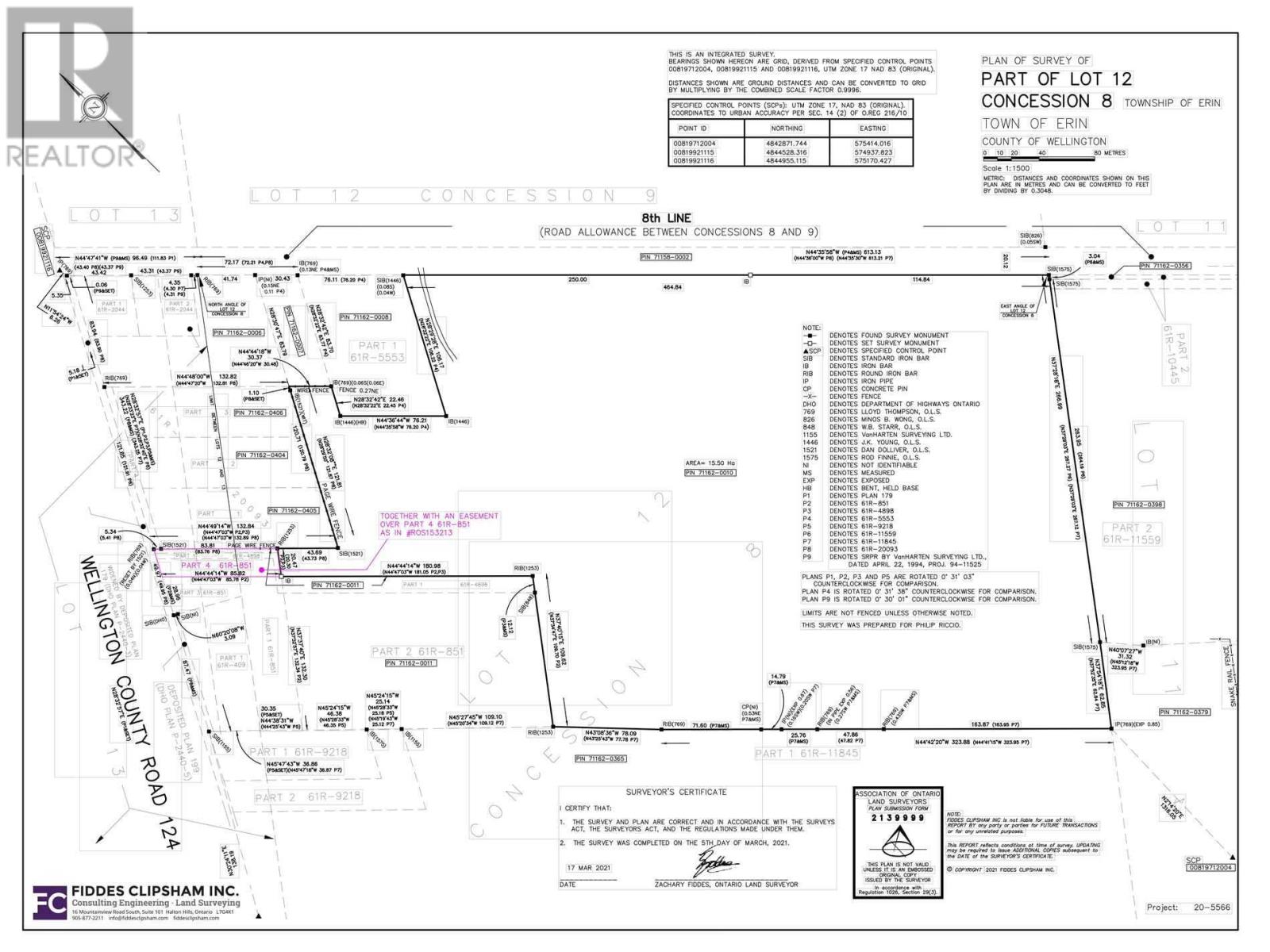

5356 Eighth Line Erin On Land Lot For Sale Rew

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. You can do this by paying more than the monthly or fortnightly or weekly minimum amount. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term.

Making bi-weekly payments means you need to have extra savings because you will be paying a little. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Likely to be approved and offered competitive rates.

Mortgage overpayment calculator. Use this calculator to determine the total cost in todays dollars of various mortgage alternatives taking into account your opportunity cost of money. If a loan is named a 51 ARM then what that means is the loan is fixed for the first 5 years then the rate resets each year thereafter.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. It includes insurance. Rates on 15-year loans also declined Monday giving up.

To illustrate savings weve made the following assumptions. They were available via NSI the Governments savings arm. Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment.

Mortgage Closing Date - also called the loan origination date or start date. A calculator that uses slider bars to graphically show the principal vs. Your Mortgages Split Loan Calculator is a great tool for people that want to get an idea of how a split home loan will work for them.

Making mortgage overpayments simply means paying more towards your mortgage than the amount set by your lender. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

The results displayed are based on the information you have entered. Skip to main content. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

First Payment Due - due date for the first payment. With the rise of technology and automation who knows what the world would look like in a quarter century. Interest breakdown over the period of the mortgage.

This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing. In Nevada the average local tax adds an extra 138 to the state sales tax for a combined rate of 823. Use our extra and lump sum repayment calculator to see how making extra repayments can reduce your loan amount.

Choose your mortgage account then Manage my mortgage. Please note the early mortgage payoff calculator does not take into. The results are based on a repayment mortgage.

Please note the calculator does not factor in any early repayment charges. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Using the split loan calculator. Let us know a bit about your mortgage and your spending to see what extra we may be able to lend you on your mortgage.

The other way to make extra repayments into. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. 14 shares Can we avoid paying extra stamp duty.

Your overpayment could be in the form of a one-off one lump sum or you could pay an extra amount each month on top of your usual repayments. After the initial introductory period the loan shifts from acting like a fixed-rate mortgage to behaving like an adjustable-rate mortgage where rates are allowed to float or reset each year. In Clark County Nevada where Las Vegas is located the county tacks on an extra 153.

However borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. Now at 526 the average is at its lowest point in two months and is more than a percentage point below mid-Junes 14-year peak of 638.

There was a one-year bond paying 28 AER and a three-year bond paying 4 AER. Your mortgage can require. Aside from paying off the mortgage loan entirely typically there are three main strategies that can be used to repay a mortgage loan earlier.

Theyre special savings bonds for over-65s colloquially known as Pensioner Bonds although their real name is the grand-sounding 65 Guaranteed Growth Bonds. A number of years would you like to pay off your mortgage. Front-end DTI The percentage of your income that goes toward paying mortgage-related debts.

Our calculator can factor in monthly annual or one-time extra payments. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining. The early mortgage payoff calculator allows you to find out how much interest you will save paying off your mortgage early.

The average two-year fix increased by 014 per cent this month to 238 per cent- while the equivalent five-year fixed rate increased by 013 per. Paying extra on your. Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders.

The interest rate will remain the same for the term of the mortgage. 601 660. There are two ways to use the early mortgage payoff calculator.

In the US the Federal government created several programs or government sponsored.

5356 Eighth Line Erin On Land Lot For Sale Rew

Real Estate Business Promotion Flyer And Poster Template Postermywall Real Estate Flyer Template Poster Template Business Promotion

Sample Eviction Notice Template 37 Free Documents In Pdf Word Letter Templates Eviction Notice Words

Early Retirement Blog

38 Creative Patio Garden Floor Decorating Ideas With Patterns For 2022 Landscaping With Rocks Garden Floor River Rock Landscaping

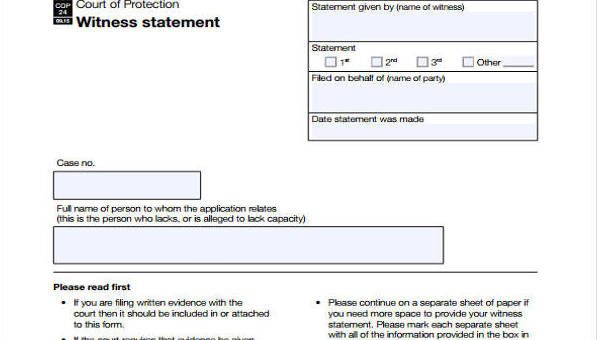

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

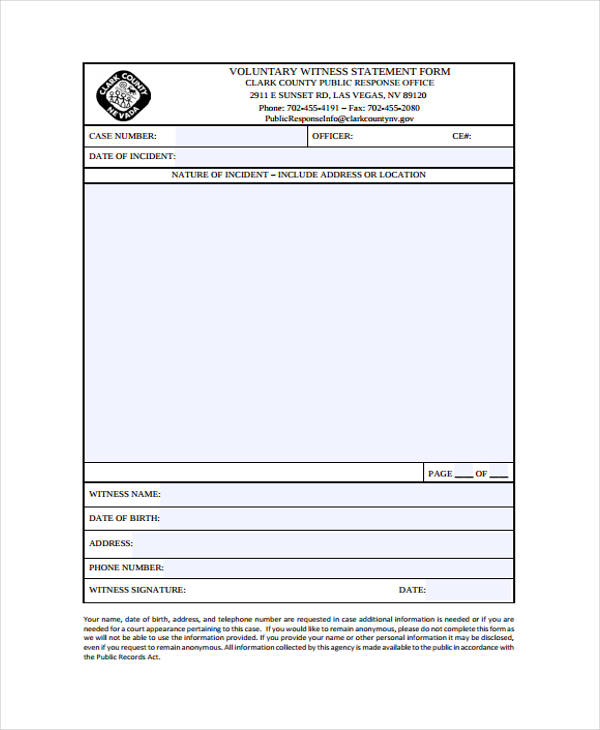

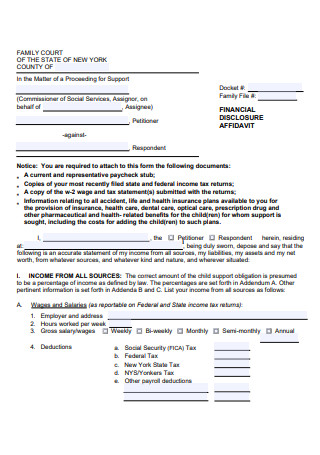

38 Sample Financial Affidavit In Pdf Ms Word

38 Property Management Wordpress Themes 2022 S Best Wp Templates For Landlord Rental

Free 38 Example Of Statement Forms In Pdf Excel Ms Word

38 Sample Financial Affidavit In Pdf Ms Word

38 Property Management Wordpress Themes 2022 S Best Wp Templates For Landlord Rental

G64421mmi057 Jpg

5356 Eighth Line Erin On Land Lot For Sale Rew

Free 38 Sheet Samples Templates In Pdf

Free 9 Loan Spreadsheet Samples And Templates In Excel

G64421mmi016 Jpg

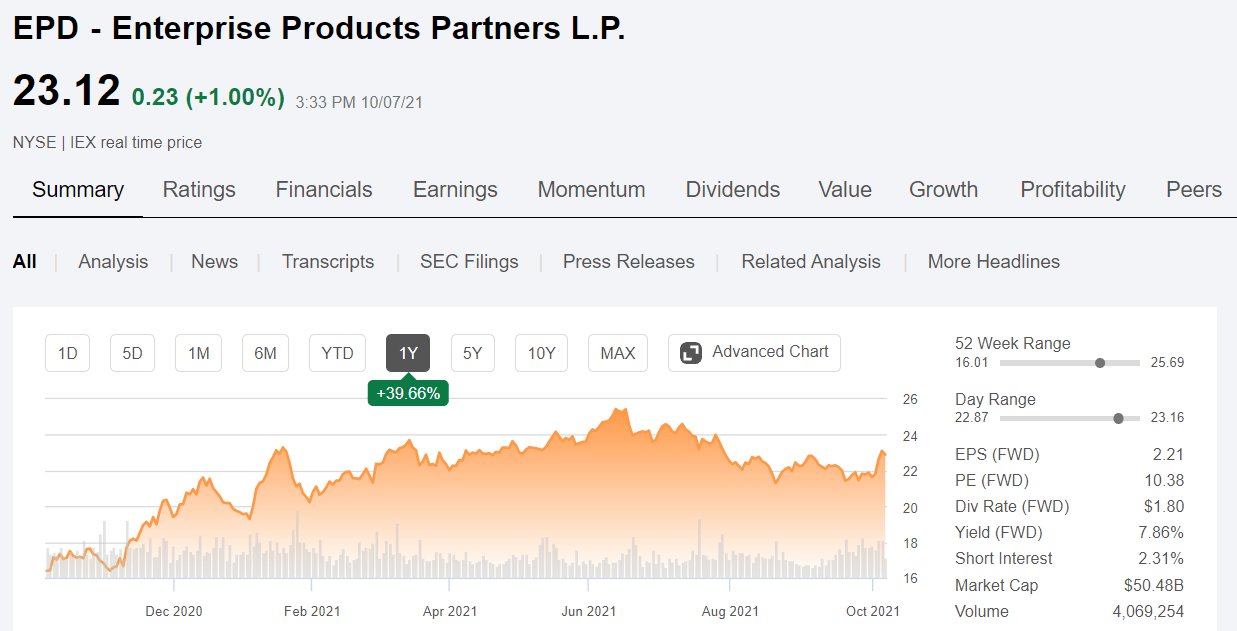

Enterprise Products Partners Stock Compelling Value Nyse Epd Seeking Alpha